It’s safe to say that no one’s financial situation is perfect. However, while some people aim for not having any debt at all and try to live by their own means, other people are ears up in debt and there is no way they are going to get rid of this debt soon. If you have poor finance managing skills, it doesn’t matter how good your job is or how much money you make in a given period of time – there is still a chance you will continue to pinch pennies and struggling to make ends meet. Find out what you may be doing wrong and do it the right way!

1. You don’t know the value of money

As one of the most versatile things in the world, money can be used in a number of different ways. You can make money, spend money reasonably, waste money, and use your money to make even more money. You probably work hard to make the money you make right now, but if you spend large amounts of cash without thinking twice, it means your money is going to waste. Learn the value of money and adjust your spending accordingly.

2. You buy instead of renting

Here we’re not just talking about property, although in some cases buying your own property is a worse option than perpetually renting. However, with a lot of household appliances, kitchen utensils, gardening items, and other stuff, it makes no sense to splash out on something you’ll only need once. For example, if you need a large frying pan for a dinner party you’re planning to hold, don’t run to the store and buy one – ask your neighbours and friends if they can help you with that.

3. You buy everything full-price

With a lot of items like underwear, makeup, baby products, and other goods, it’s advised to only buy these items new. Nevertheless, there are lots of other goods you can buy used without sacrificing the quality or look of the item. By shopping at websites like JiJi you can find everything you need at the lowest prices possible. Smartphones, clothes, shoes, furniture, cars, laptops – you can save a lot of money by buying used items that are in an excellent condition. Use the money you save to eventually buy your own apartment or fulfill another lifelong dream.

4. You pay too much attention to labels

Generally speaking, the only places where labels really matter are cars, certain types of gadgets, and other high-tech items. In other cases overpaying for clothes, shoes, accessories, furniture, and other goods from famous brands is not the smartest thing you can do, because most often buying expensive items from well-known brands has no advantage in quality or longevity compared to other more affordable items. Don’t chase certain brands and labels, and you’ll see how easy it is to keep your money instead of wasting it.

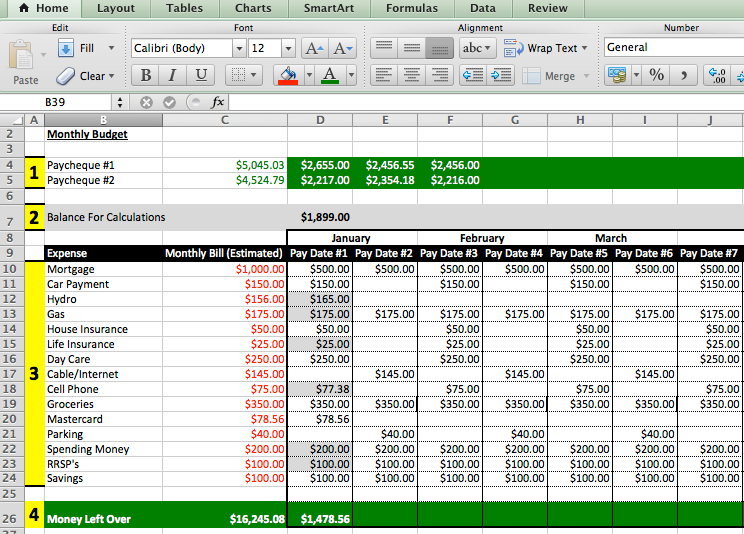

5. You don’t have a budget

We know it might sound boring, especially if you’re young and carefree, but having a budget is one of the cornerstones of being a financially successful person. Track down all of your sources of income, as well as your expenses. Soon you will know if you are in debt or have free money, and will be able to decide if you can afford that shiny new pair of shoes or if that purchase cannot happen right now. There are lots of useful online budgeting tools, but if you’re just starting, a simple notepad and a pen, or an Excel spreadsheet will do.

6. You don’t focus on your goals

Most people save money in order to achieve one or multiple goals – buy their own property, start their own business, move to the city of their dreams, etc. What you need to do is set your own goals and work towards reaching them. When your goals are unclear, or if they are not as important to you as they should be, it becomes tempting to take the money you save and spend it on impulse purchases. In this situation you have to either rethink your goals and aim for something you find important, or become more focused on achieving the goals you originally chose.

7. You have money-draining habits

In our daily pursuit of success becoming overwhelmed with stress and commitments is not a rare thing at all. We all have different ways of coping with stress. Ideally, you eliminate stress and fatigue by doing your favourite hobby. However, a lot of adults choose drinking, smoking, gambling, overeating, impulse purchases, clubbing, and other habits that not only drain their finances, but also negatively influence their health. These money-sucking habits won’t do you any good, so the sooner you get rid of them, the better.