The internet has given us many wonderful things, and one of the most helpful ones is the ability to take out loans without even leaving your home. Check out 8 online services and apps that allow you to get personal loans without any collateral.

Make extra money by selling on Jiji

1. Aella Credit

Aella is an app-only credit platform that was launched exclusively for the employees of their network but was later made available to all Nigerian customers. You can take out loans from ₦5,000 to ₦100,000 with a 4%-29% monthly interest rate. If you repay your loan on time, your loan amount will get bigger and your interest rate will get lower.

Read more: How To Apply For A Loan In Nigeria

2. Fairmoney

Fairmoney is one of the newer online loan platforms available in Nigeria. It’s a mobile app that can give you a loan up to ₦150,000 with a duration period from 14 days to 3 months with no collateral or guarantors. If your loan application is approved, you can get the money in as little as 5 minutes.

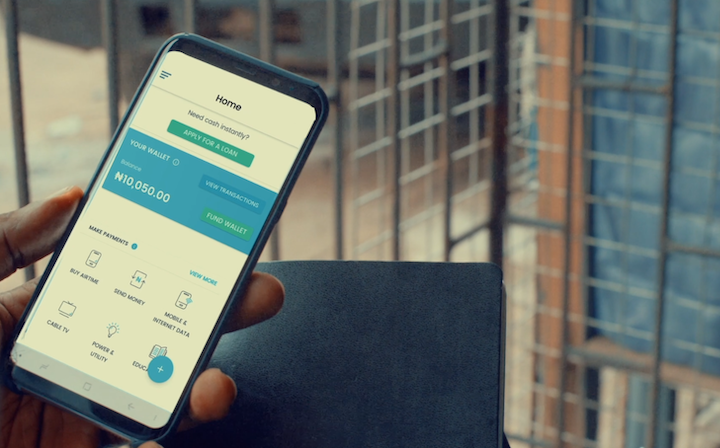

3. Paylater

Paylater is a mobile app loan platform that allows you to take up to ₦1 million in loans with just your BVN, address, and passport scan. The app will then calculate your risk level and assign an interest rate from 12% to 15%. You will need to repay the loan in 3 to 12 months. Overall, Paylater is best suited for bigger loans with a short repay period.

Read more: How To Check BVN In Nigeria

4. Rosabon

Rosabon is a comprehensive loan platform that is available both on desktop and mobile versions. Getting a loan through Rosabon will require a little more proof of your reliability than most other apps on our list: you will need to provide proof of employment, your tax ID or pension account, and a recent utility bill. However, the 4%-6% interest rate for a 3 to 12 months loan tenure is certainly worth the longer preparation process.

5. Pledge Financial

Pledge Financial is a unique short-term loan solution that requires you to receive a Pledge Finance debit card that will be pre-loaded with up to ₦500,000, depending on your financial record. The card is valid for 3 years and you will need to make a one-time ₦1,500 payment for the card. The interest rate is 15% for loans from 3 to 12 months.

6. KwikMoney

KwikMoney is a highly accessible service that is aimed at small salary advance loans instead of bigger loans. This platform operates on desktop, mobile and even USSD. With KwikMoney, you can take up to ₦15,000 in a loan for up to 15 days with a 15% interest rate. A BVN is required to obtain a loan from the platform.

7. KiaKia

KiaKia is one of the most innovative loan platforms operating in Nigeria right now. Essentially, KiaKia is an intelligent bot that tells you how much you can borrow, what the interest rate is going to be, and how soon you need to repay the loan. As a new user, you can take out up to ₦5,000,000 for 30 days, while returning users can repay the loan in up to 6 months.

8. Renmoney

With Renmoney, you can borrow up to ₦4,000,000 without collateral. The interest rate is about 4.5% per month. The loan should be repaid in 3 to 12 months. The interesting thing about Renmoney is that there is a variety of methods for repaying the loan, including online transfers, POS, cash payments, and Quickteller.

Read more: 7 Money Habits You Should Break Right Now!

Get an extra income by selling on the Jiji app