In spite of the fact that a credit card is a very widespread means to pay for products and services, most people do not realize yet what risks are in paying via the Internet with such cards. We offer to get to know some helpful methods to secure your credit card against tricky online shops frauds.

According to the statistics, in 2013 nearly 10 % of Americans became the victims of credit card rip-offs; the average stolen sum was about $400.

Undoubtedly, only developed countries have such dimensioned fraud level.

So how can you be sure that your money is spent only by you and not by some other guy sitting near in front of you in a café?

1. Pay only on websites you trust

If you send money to your mobile phone with the help of some service, it’s good, continue using it.

In the top search systems frauds resources can also be found, moreover, it’s hardly possible to check the source quickly and reliably.

“I didn’t appeal to the police since the person who stole it spend much less than my wife.”

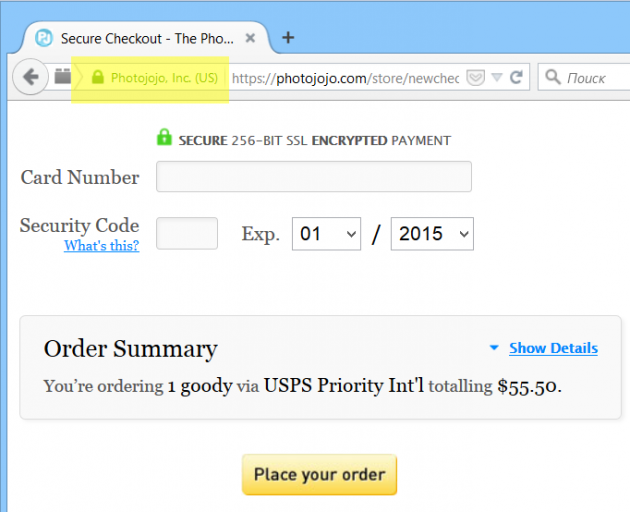

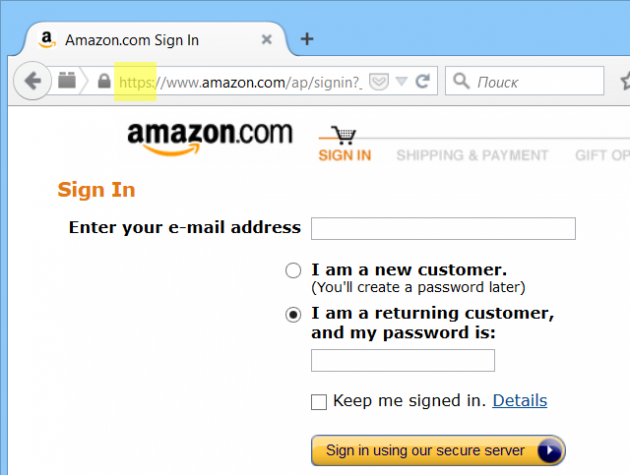

2. Make sure a website includes HTTPS

According to the VISA and MasterCard standards, the bank cards data have to be transmitted with the help of secure connection.

If a website includes the HTTP sign, do not leave your card information there! Even if an online shop with such address is not a fraud, any other frauds are able to intercept the data.

You can 100 % trust websites with green address bars.

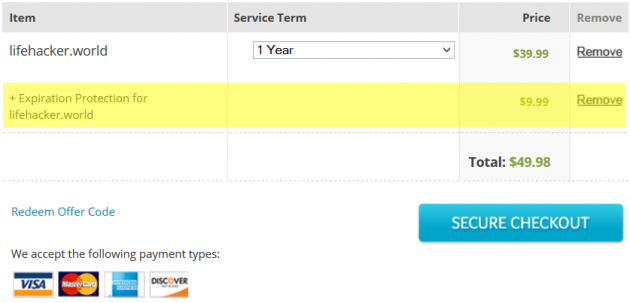

3. Always check the sum of money you want to pay

If you are sure that your payment is safe, it does not mean you have not to worry about your money safety.

From time to time online shops and services add some extra services or other goods. Of course, you did not look through your payment form and click the “Pay” button.

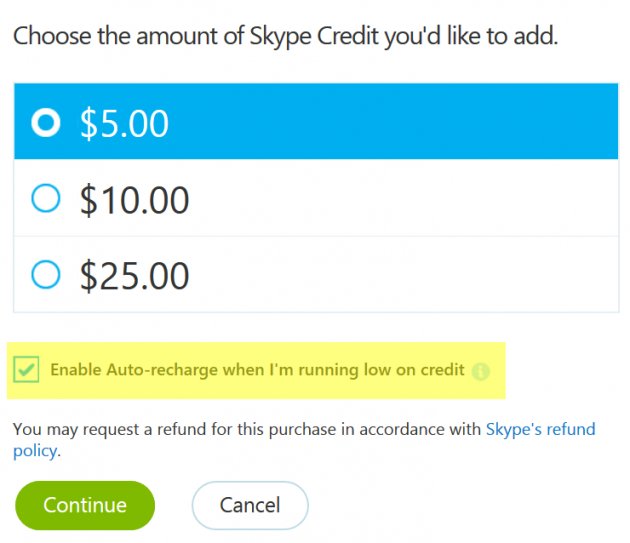

4. Protect your credit card against the repeated payments

Perhaps, it is a well-known fact, but not only is your bank able to charge off your money of the credit card. Almost all chargeable online services can “for your convenience” prolong your subscription, charging off some money from the credit card you gave them earlier.

Look attentively what are you agree with while making an order.

Another method to prolong your subscription is to offer a free trial period firstly and then continue it automatically without you awareness.

5. Control the money which are charged off from your bank account

Any up-to-day bank provides access to the online banking system where you are able to look through all your payments.

In banks with poor-developed online banking system your payment can be set off with some delay, so sometimes it is pretty difficult to get access to these payments. We recommend setting SMS-banking for your mobile phone while registrating a new credit card. SMS will inform you about all the payments and other spendings in real time mode.

Thus, you will be able to control your credit card incomes and outcomes.

The optimal possible variant is to open a virtual card in the Internet. In such a way you will put money in some portions (sums which will be enough for your appropriate payments). You will be 100 % sure that your money will not disappear from your bank card.

Have anything to add? Share HERE, please.