For many Nigerians, renting a house or apartment is the only way to move out of their parents’ home and live separately. Saving up for your own place is famously difficult, and taking out a loan means you’ll have a financial burden for decades. Here is how to calculate how much you can spend on rent every month.

Find your ideal property for rent in Nigeria on Jiji

1. 30% rule

For many years, the most popular approach to calculating the amount of money you can spend on rent every month, people used the 30% rule. To know the exact number, first you need to know how much you make in 12 months.

Read more: 12 Popular Jobs In Nigeria To Consider

This is especially useful if you don’t have a fixed income and your monthly salary varies from month to month. For example, if you calculated your annual salary to be ₦1 million, it means that your average monthly salary is ₦83,000.

Using this number, you simply calculate how much money equals 30% of your monthly income. In our case, this number is ₦24,900. Therefore, the biggest amount of money you can spend on rent every month is ₦24,900.

However, even though the 30% rule has been used since the 20th century, many consider it to be outdated in the modern world. The reason for that is the fact that decades ago, people had fewer expenses and could afford to spend more on rent. In today’s reality, giving away 30% of your monthly income for housing is hardly affordable for millions of Nigerians.

Read more: How Do You Find Houses for Rent

2. 50/30/20 rule

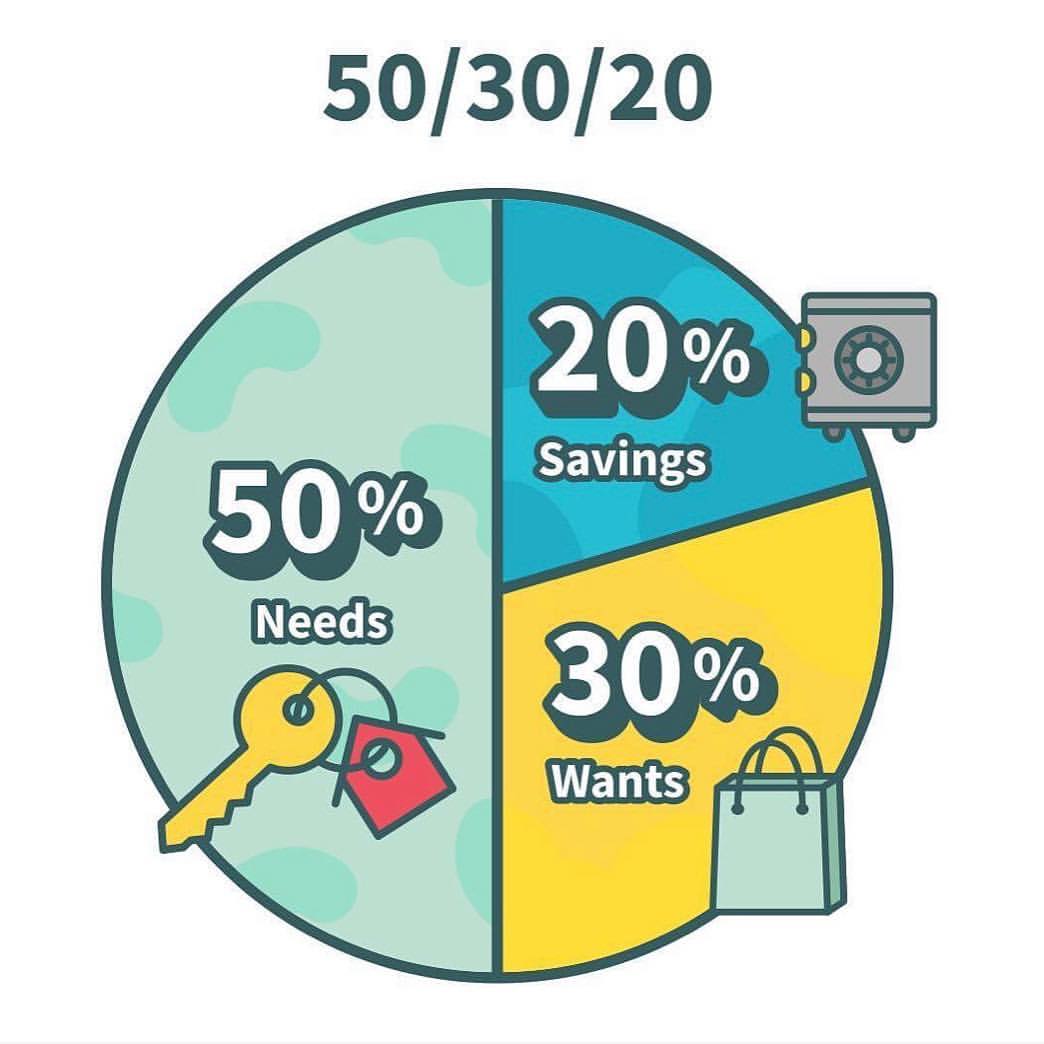

As soon as people realized that the 30% rule is outdated and impossible to follow in many situations, the economists came up with another way to calculate your monthly rent limit. This strategy became known as the 50/30/20 rule and it’s slightly more complicated. According to this strategy, your monthly income is divided into the following categories:

- 50% for needs. The essentials include housing, which, in your case, is rent, as well as groceries, car expenses, debt payments, school payments for your children, and regular medical expenses – for example, medications that you need to take continuously.

- 30% for wants. This category includes expenses that are not mandatory but that improve your quality of living. The most common examples are your hobbies, shopping (other than grocery shopping), sports expenses, vacations, dining out and entertainment expenses.

- 20% for savings. If you have a goal that requires money – for example, a car or your own house, this is the most effective way to regularly save money. Here you should also consider creating an emergency fund in case you suddenly lose your job or require expensive medical treatment. It’s also a good idea to save a portion of your income for retirement.

According to this approach, rent is included in the 50% essential part of your expenses. However, since there are several other mandatory expenses, it can turn out that your rent is either lower or higher than 30%. If none of the other spheres in your life suffers because of rent, it means that you calculated your monthly expenses correctly.

Read more: 7 Money Habits You Should Break Right Now!

Buy, sell, and rent property with the Jiji app